Since not many India Budget proposals fructify into real time accomplishments, some economists quip they are airy fairy dos of exalted mandarins. Certainly not to be confused by mere mortals as actionables. Yesteryears, saw the powers to be, as well corporate honchos, waxing eloquent on ensuing Budgets and emphatically vocalizing mutual expectations. This year though, there seems to be a studied silence. Gone are the elaborate media interactions and info dropping by allknowers. One can understand, the Hon’ble Minister, unwilling to partake in media deliberations, which usually end up in creating more misunderstands, than actual shedding of light. Even the usual dipstick for gauging citizens’ mood seems to have been given a bypass. In such suspenseful atmosphere, veteran economists and bugetarians dare not open their mouth. After all, even kite flying can be done only when some wind is there. Mercurial, World Geopolitics, Continuing Wars, Gen Z Civic assaults, Religious hardening and Tariff Weaponization, swiftly made armchair experts realize, silence is golden! Most doyens prudently zipped up. Even Davos soirees and AI conjectures could not coax them. Discretion is always the better part, being valorous can wait, at least till the Budget is announced.

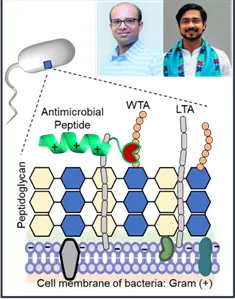

NewsIP in a humble attempt wishes to put across for esteemed readers’ certain facets concerning Budget – 2026. Interestingly, despite popular demand, there has never been a concerted effort to carry out a full-fledged analysis of Last Budget attainments before a Fresh Budget is presented. Every kindergartener knows, Report Cards are difficult and pernicious contraptions to face. Needless to mention, Babus of every hue, are most comfortable in such a circumstance, know all but speak not. The Annual Financial Statement is surely not enough. Anyway, coming to Budget 2026, there is again the déjà vu reference being made to Taxes. The Income tax New Regime would be made more beneficial so that Income Tax Payers gravitate to it. More likely, the Old Regime will be made cumbersome and quite onerous, resulting in hot potato reactions. As usual, the middle class has put forth many mercy petitions for IT Relief but surely this year too too,it will be of no avail. Cosmetic changes are all they can hope for. Despite healthy takes for the collectorates in Indirect Taxes. In the last financial year, the gross GST collections in India reached Rs22.08 lakh crore, a healthy year-on year growth of 9.4 percent. Compare this with the Net Direct tax Collections till January 11 was at Rs 18.37 lakh crore, up 8.8% YoY. Out of the direct tax collections during FY 2024-25, gross collections being Rs. 25,86,947 Crore; Rs. 12,40,308 Crore from Corporate taxes, Rs. 12,90,144 Crore from Personal Income tax, Rs. 53,095 Crore from Securities Transaction Tax (STT), and Rs. 3,399 Crore from Other taxes. As compared to the corresponding period of last fiscal year, the net direct tax collections were up 8.8 percent on year on year basis. However, the growth is lower than the projection made in the last Budget. The Corporate Sector will as usual expect further Tax Breaks but the moot point is whether they at all deserve it? Their contribution to nation building has been found to be wanting. Despite emphasis on Capex in the last few Budgets, there has not been significant offerings to building of infrastructure and capital investment in core areas by them. Quick returns, is what the private sector eyes. PSU investments may be a logical step but private monopolies in most sectors – Power, Coal,Telecom, Automobile, Non Conventional & Conventional Energy, Aviation ,Banking and now 100% equity for Insurance sector has already taken firm roots, maybe that’s the will of the government. Next in the list of priorities for the common citizen is the eternal Unemployment/Underemployment in India. India created 4.66 Crore Jobs in FY24; employment growth rate rose to 6% as per RBI data. The country employed 59.66 crore people in 2022-23 across 27 industries, with year-on-year employment growth of 3.31%, contributing to a 6.6% change in the gross value addition. But there is still a huge backlog. This is a huge huge concern and requires urgent, serious, workable solutions. Merely a stoic face and kindergarten approach will not serve any longer. Pushing educated youth to Gig working is hardly a viable solution. Certain issues of the ‘human mules’ have reached even the highest court of the country The Manufacturing Sector, IT, Agriculture needs to do significantly more. Mitigating potential US tariff impacts through strategic market diversification will become significant. Climate resilient agriculture, regenerative practices, solid risk protection mechanisms, a national scale Digital Public Infrastructure (DPI) for agriculture is another essential. Associated with the unemployment issue is the skills development staple where real future proof skills inputs are required. Allocation of funds and spending is simply not enough. According to the World Economic Forum’s Future of Jobs Report 2025, the skills required for the workforce by 2030 include:AI and Big Data: Essential for decisionmaking and efficiency across various industries. Technological Literacy, Resilience, Flexibility, and Agility: Important for adapting to fast-changing environments, Creative Thinking and Lifelong Learning. Overall, the report indicates a significant shift towards skills that are adaptive, innovative, and digitally fluent, reflecting the evolving nature of the job market. How about setting up a cross discipline expert group under aegis of Niti Ayog with a time bound skills plan for next half a decade for India? Gold & Silver are expected to keep rising and with Dollar taking a beating India should have been able to capitalize but it has not happened. Some economists say Rupee is overvalued and there is scope for further fall. The INR is continuing to depreciate significantly and 1 USD today stands at Rs 84.097. Surely it should be concerning. The Fiscal Deficit for Budget 2024- 25 was 4.8% of GDP which is set to reduce further in this Budget. In fact, Consumer expenditure should rise in order to give the much needed push to Indian Economy, one has to see whether enthusiastic spends return to Indian consumers. Inflation has been by and large under control which should be cause of cheer for the consumers. Gold & Silver though touched astronomical heights mainly due to international forces. It has to be seen whether the ensuing Budget can control this and the sliding Rupee. In the Medical & Health arena much is required to be done. Service Delivery, Education, R&D, all can do with a bit of infusion of funds. Imports of devices have become a source of concern. Reforms regarding Intellectual Property Rights and reduced patent approval timelines is the call of the day. Space is no longer the ultimate frontier and despite giant leaps and promises of entry of Private players still lot needs to be still done. There is a call for GST and Customs Duty exemptions for ground systems, parts of launch vehicles/satellites and other services. There is also need for establishing a “National Geospatial Mission” to unlock data-driven applications. AI calls for a new approach altogether. Data sovereignty for India has become a priority. Learning initiatives to build AI knowledge and Data Skills for all is an absolute necessity. One can carry on and on with the wish list but most important is to delink the Budget process from political compultions. It should become a purely economic exercise, slightly better in scope than mere balancing of Books.

Lastly, there is much expectation from MOD with EU (yes deals also have mothers) but it should be approached cautiously. After all, this is Europe, where individual nations, have traditional ties with the West. Opening of Indian markets will be welcomed by them but how much consequential benefits will accrue to India needs to be seen. Racial undertones may negate easy portability of human resources, after all, the colour of their card is Blue, not even Green(sic). And cards of all hues of colour, seem to come with strings attached!